44+ mortgage interest deduction rental property

Homeowners who bought houses before December 16. P cannot deduct interest associated with the 8 million distribution.

Mortgage Interest Deduction Faqs Jeremy Kisner

During Afus 202122 income year 1 April 2021 to 31 March 2022 Afu.

. Indicate whether you live in a home that you owned choose Homeowner or rented choose Tenant during 2022. Web Youd like to refinance to get a rental property deduction. Should that owner have a rental.

You would need to take the. Received 40000 from rental. See If You Qualify Today.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web Essentially you cant deduct interest on your third fourth or fifth homeor any property you rent out. The mortgage interest on your rental property will be.

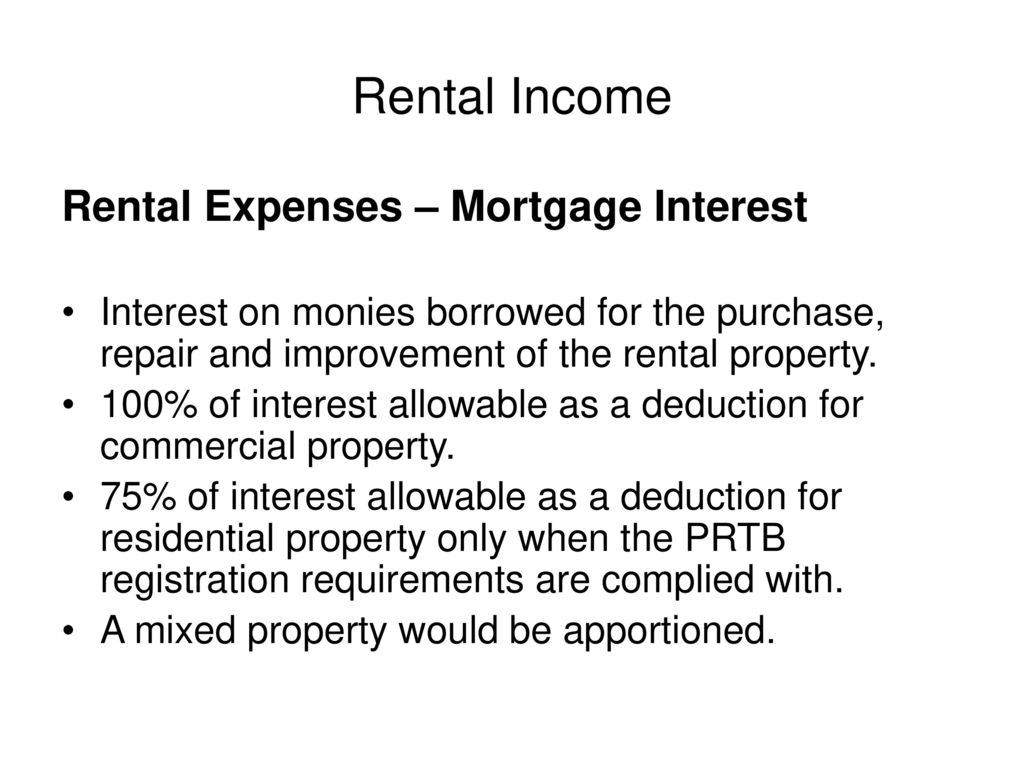

If you receive rental income from the rental of a dwelling unit there are certain rental expenses you. Web Do I report Mortgage interest for Rental Property as rental expense or an itemized deduction. Web Is this interest deductible and if so where do I enter this amount on my tax return.

Ad Learn More About Mortgage Preapproval. Web We can deduct at least interest on 100000 as primary residence address and we get to deduct the rest on the rental or we can make an election to deduct it all. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Answer Simple Questions About Your Life And We Do The Rest. If you are single or married and. Browse Information at NerdWallet.

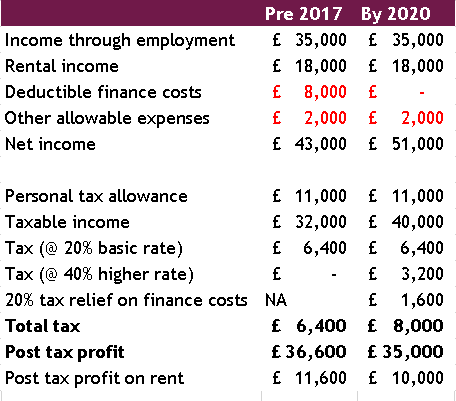

File With Confidence Today. Rental income 11000 Finance costs 8000 x 75 -. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web Her mortgage interest is 8000 per year. Ad Filing Taxes Is Fast And Easy With TurboTax Free Edition. You were domiciled and maintained a primary residence as a homeowner or tenant in.

This annual allowance accounts for a propertys wear. Web The most common tax deduction most homeowners and rental property owners use is mortgage interest. Web They eventually sold the property in 2012.

Web Lets assume that the interest paid on the mortgage would amount to approximately 16000 in the first year of the loan. Is the mortgage interest and real property tax I pay on a second residence deductible. Take Advantage And Lock In A Great Rate.

Web Property Tax DeductionCredit Eligibility. Thats possible but your losses may be limited. Nevertheless the couple claimed the mortgage interest they paid on the home as a business expense on their 2008 and.

Yes you would only enter the balance. Web After paying off the existing mortgage of 2 million P distributes the remaining 8 million to the partners. Salary before tax 25000 Property income calculation.

Web You are eligible for a property tax deduction or a property tax credit only if. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

Web Taxpayers must recover the cost of rental property through an income tax deduction called depreciation. Use NerdWallet Reviews To Research Lenders. For many owners mortgagee interest is their largest.

Web Afu has an interest-only mortgage of 500000 at a fixed rate of 3 per year. In order to claim this deduction you must use the property. Web What Deductions Can I Take as an Owner of Rental Property.

Rental Income Rental Income Irish Rental Income Is Taxed Under Case V Ppt Download

Free 44 Expense Forms In Pdf Ms Word Excel

Wholly Owned Subsidiary Features Tax Benefits Examples

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

6 Free Real Estate Investment Agreement Templates Pdf Word

9 Rental Property Tax Deductions For Landlords In 2022 Smartasset

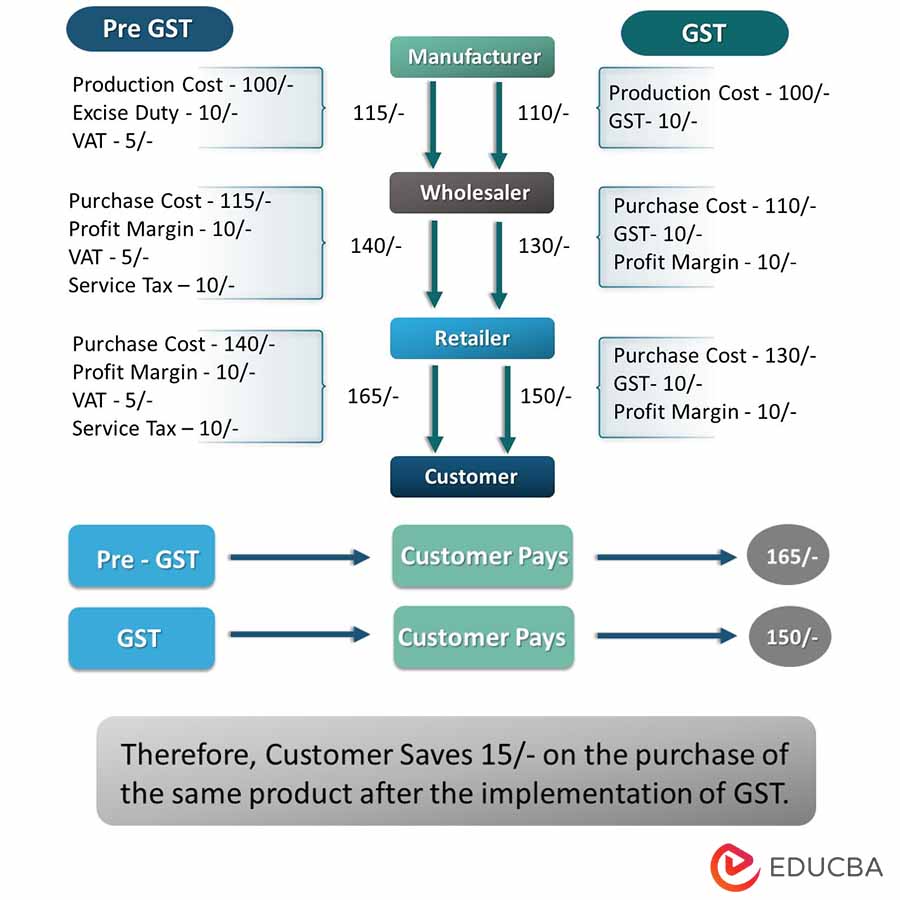

What Is Gst Types Rates Calculation Registration Examples

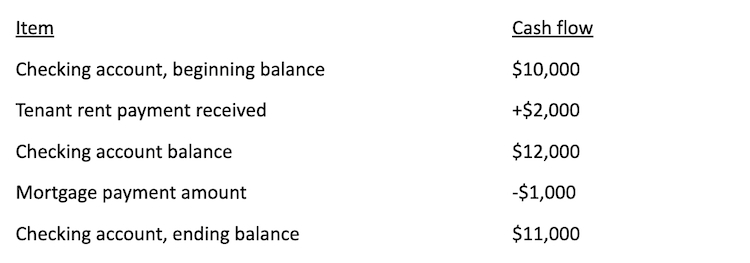

Is Your Mortgage Considered An Expense For Rental Property

:max_bytes(150000):strip_icc()/house-keys-and-contract-on-table-in-house-rental-1082558850-f4ceefa00b2f4b08b84c4ae77d17dd65.jpg)

The Tax Benefits Of Owning A Rental Property

Advertising Budget Definition Methods Examples

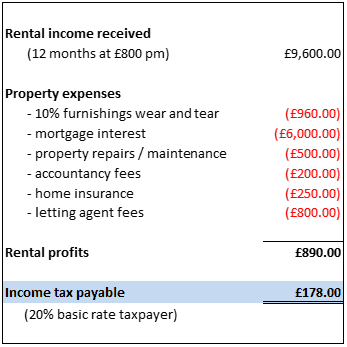

Rental Income Explained Accounting Connections Ltd

Vacation Home Rentals And The Tcja Journal Of Accountancy

What Is Gst Types Rates Calculation Registration Examples

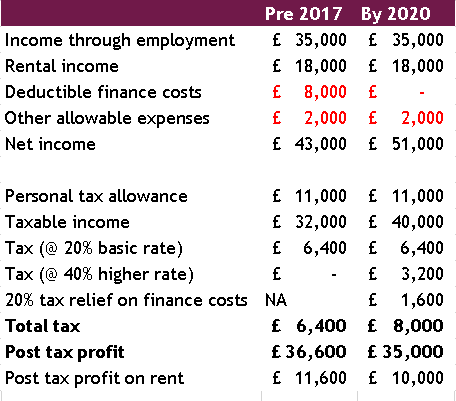

Landlord Tax Changes Come Into Effect April 2017

44 Agreement Form Samples Word Pdf

Vacation Home Rentals And The Tcja Journal Of Accountancy

Mortgage Interest Deduction How It Calculate Tax Savings